如果您想快速向某人汇款,您有很多选择。但是,使用人数最多的两种最受欢迎的服务是PayPal和Venmo。

两者的主要目的是相同的:将钱从您的银行账户中转入其他人的账户(或相反)。但是,这样做的过程在Venmo(Venmo)和PayPal之间略有不同。

即使您已经了解有关PayPal的所有信息,您也可能想知道:什么是Venmo,它是否比PayPal更好?

什么是文莫?

Venmo让您可以使用信用卡、借记卡或您的银行账户立即向某人汇款。许多人没有意识到PayPal实际上拥有Venmo。Venmo本质上是同一家公司提供的一种更简单的替代支付服务。

添加付款详情(Adding Payment Details)

注册Venmo帐户后,您只需添加付款方式即可开始汇款或收款。您可以在付款方式(Payment Methods)下的应用菜单中找到它。

只需选择添加银行或卡(Add bank or card),然后在付款方式表单中填写帐户详细信息。

添加付款后,您就可以开始使用该应用程序了。

发送或请求付款(Sending or Requesting Payments)

在主应用程序屏幕上,您可以点击蓝色的发送付款(Send Payment)图标来创建新的付款给某人,或请求付款。

其他用户将需要一个Venmo帐户,以便您可以搜索他们的姓名或Venmo用户 ID 以发送付款。

您只需要:

- 选择您要汇款的用户

- 输入金额

- 输入(Enter)您汇款的原因(可选)

- 设置(Set)交易的隐私(Prive、Friends或Public)

- 选择支付(Pay)(或请求(Request))以向该人请求金额

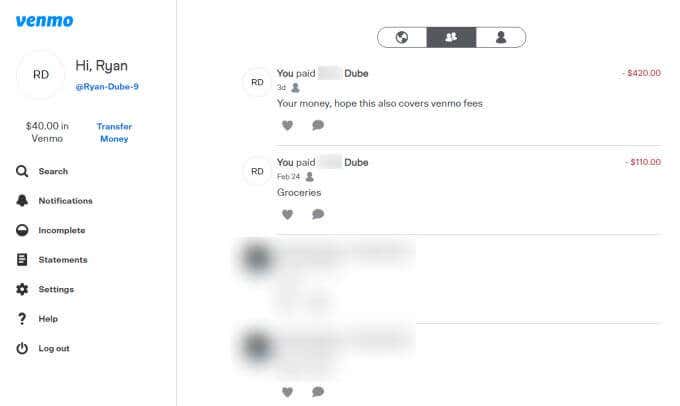

您将看到此交易出现在应用程序的主页上。您可以随时在历史记录中点击该交易以查看付款详情。

汇款到您的银行账户(Transfer Money to Your Bank Account)

每当有人向您汇款时,您都会看到它出现在您的Venmo余额中。您可以随时点击菜单顶部的转账余额(Transfer Balance)链接,将资金转入您的银行账户或信用卡。

转账余额(Transfer Balance)页面将显示您可用于转账的全部余额。您可以支付 1% 的费用即时转账到您的银行或信用卡,或者最多可以免费转账三天。

获取 Venmo 借记卡(Get a Venmo Debit Card)

您可能已经听说过Paypal 借记卡(Paypal debit card),它可以让您立即访问您的 Paypal 资金,以便在任何离线或在线商店(any offline or online store)进行付款。

现在Venmo提供相同的功能:Venmo借记卡。

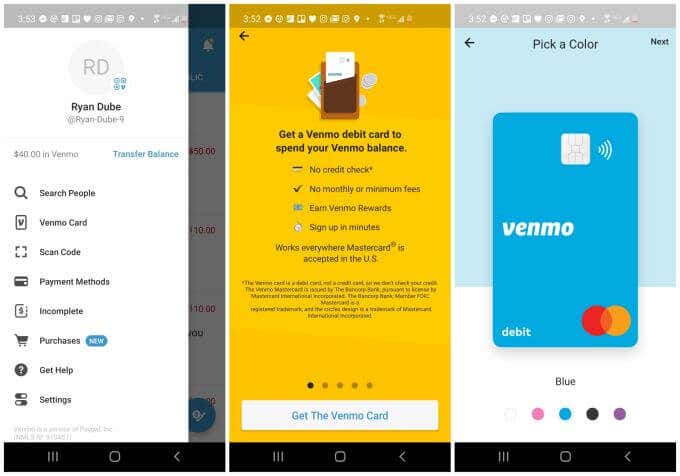

您可以通过点击应用程序菜单中的Venmo Card来注册一个。(Venmo Card)

只需通过向导进行注册即可。您可以从 4 种基本颜色中进行选择。这是一张万事达(Mastercard)借记卡,因此几乎适用于任何企业。它也是一张奖励(Rewards)卡,因此您每次使用它都可以赚取积分 - 并且没有与之相关的信用检查或月费。

Venmo与Paypal:有什么区别?

您可能已经注意到Venmo和Paypal有很多共同点。除了非常不同的用户界面外,这两种服务非常相似。

主要区别之一是Venmo几乎就像是一种支付服务和社交网络合二为一。您可以在该服务上添加朋友,这样以后可以更方便地向他们发送或接收付款。

费用和收费(Fees and Charges)

还有许多其他差异,有些是轻微的,有些是显着的。例如,这里是费用的差异。

- Venmo对信用卡支付收取 3% 的费用;PayPal收取 2.9% 的费用,外加 0.30 美元的固定费用。

- 使用这两种服务进行银行转账均不收取任何费用。

- 使用Venmo(Venmo)使用借记卡付款不收取任何费用;Paypal收取 2.9% 的费用,外加 0.30 美元的固定费用。

- Venmo的交易限额为 4,999.99 美元;Paypal仅将交易限制为 10,000 美元。

- 使用Venmo(Venmo)向您的银行提款更快,仅需 1-3 天。Paypal 提款可能需要 3-5 天。

哪个更容易访问?(Which Is More Accessible?)

您可以在相同的平台上访问这两种服务,包括移动应用程序,或者移动或桌面浏览器。当您在浏览器上访问 Venmo(visit Venmo)并登录您的帐户时,您会注意到一个很大的不同。

您不会像在应用程序中那样在右下角看到发送(Send)或请求蓝色按钮。(Request)这是因为使用Venmo,您只能使用移动应用程序发送或请求付款。

您仍然可以使用该网站查看您的交易历史、更新设置或请求向您的银行账户或信用卡转账。

此外,Venmo仅可在美国(United) 境内(States)使用。另一方面,200 多个国家/地区的人们都可以使用PayPal 。

Paypal也更普遍地被许多在线和离线业务所接受。

Venmo更新了很多,但仍在站稳脚跟。

能够使用这些服务直接在商店中付款意味着您不必先将钱转入您的银行帐户,然后就可以用余额购买东西。

向人们汇款(Sending Money to People)

毫无疑问,使用Venmo(Venmo)向人们汇款的过程要简单得多,也更加精简。使用Venmo应用程序,这实际上只是一个快速的三步过程,没有任何令人困惑的选项或其他选择。

如果用户有Venmo帐户,您输入金额、原因(如果需要)、是否公开分享交易,然后您就完成了。您的用户将不得不为收款支付费用,但Venmo不会用这些细节来打扰您。

(Paypal)另一方面,Paypal在主页上有Send、Request、Crypto和 More 按钮,混杂在主仪表板周围的各种其他信息中。找到将钱转到您的银行或信用卡的链接也不是很容易。

一旦你选择了Send,这个过程就不是一个简单的表单。这是一个分步向导,可根据您的选择和汇款对象更改下一个选项。

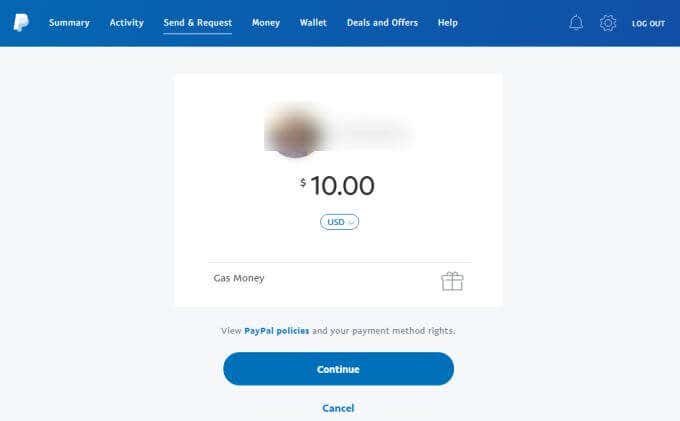

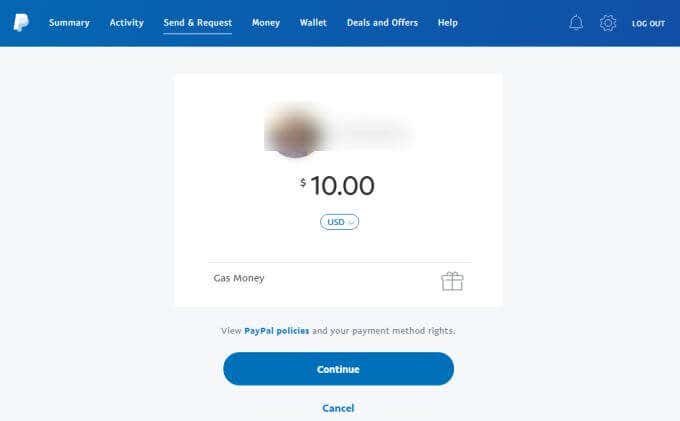

向导的第一步看起来很简单。

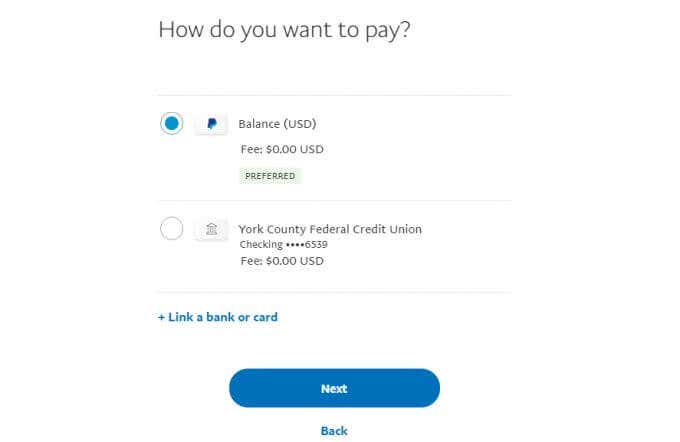

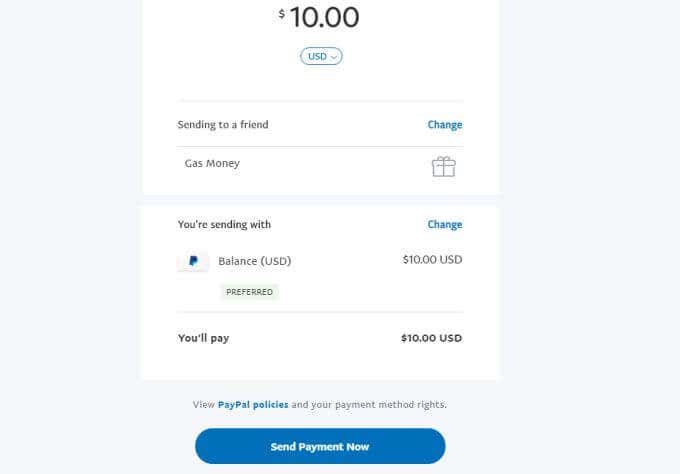

但是,在您选择Continue之后,您会看到显然可以更改的交易详细信息,例如货币、是否发送(Sending)给朋友以及您使用哪个帐户发送。

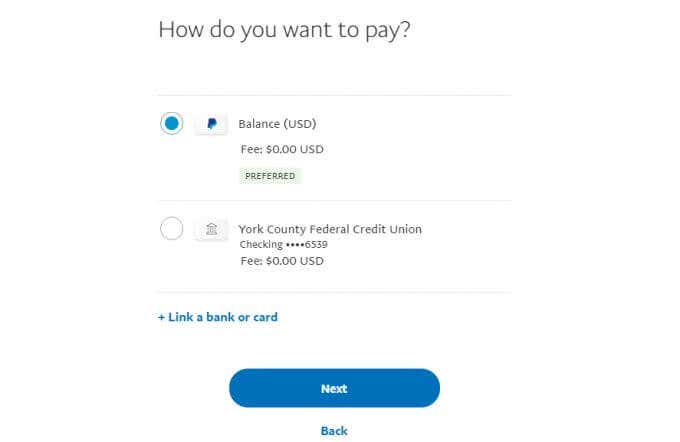

如果您选择更改帐户,您会看到可以使用您的Paypal帐户或直接从您的银行帐户发送。

为什么Paypal(Paypal)有这么多选择,而Venmo是一个如此简单的 3 步流程?

这是因为Paypal已经根据支付是否为国际支付以及所支付的费用,采用了更复杂的费用结构。

例如,如果您向朋友汇款,您可以选择支付费用或让收款人支付费用。或者您可以选择为商品或服务付款,在这种情况下,收款人必须支付费用并由Paypal 购买保护支付(Paypal Purchase Protection)。

因此,一方面,Paypal可能会提供更多的功能和选择。但Venmo通过标准化费用和其他细节简化了整个交易流程,让您只需点击几下即可完成支付流程。

其他注意事项

在您在Venmo(Venmo)和Paypal之间做出选择之前,需要考虑的其他一些重要差异:

- 当您从企业购买(purchasing from a business)时, Paypal 为买家提供安心保障(Buyer Protection)。

- Paypal 提供商业贷款。

- 您可以使用Paypal(Paypal)购买或出售加密货币。

在比较Venmo和Paypal时,我们使用了两个正式会员帐户来检查用户界面、交易流程、功能、费用和余额转移。

最终,Venmo和Paypal做同样的事情。他们都从你的银行账户或信用卡中取钱,然后存入别人的账户。不同之处在于Paypal使用起来有点复杂,但提供了更多的功能和服务。

Venmo最适合那些不想处理花里胡哨的人,只想要一个简单的应用程序来尽快轻松地向某人汇款。

What Is Venmo and Why Is It Better Than PayPal?

If you want to send someonе money quіckly, you have many choiceѕ. But the two moѕt popular serviсes more people use than any other is PayPal and Venmo.

The main purpose of both is the same: to get money out of your bank account into someone else’s (or the other way around). However, the process of doing so is slightly different between Venmo and PayPal.

Even if you already know everything there is to know about PayPal, you may be wondering: What is Venmo, and is it a better option than PayPal?

What Is Venmo?

Venmo lets you send someone money instantly using either a credit card, a debit card, or your bank account. Many people don’t realize that PayPal actually owns Venmo. Venmo is essentially a simpler, alternative payment service offered by the same company.

Adding Payment Details

Once you sign up for a Venmo account, you’ll just need to add payment methods to start sending or receiving money. You’ll find this in the app menu under Payment Methods.

Just select Add bank or card and fill out the account details in the payment method form.

Once you have a payment added, you’re ready to start using the app.

Sending or Requesting Payments

From the main app screen you can tap the blue Send Payment icon to create a new payment to someone, or request a payment.

The other user will need a Venmo account so that you can search for their name or Venmo user ID to send payment.

You’ll simply need to:

- Select the user you want to send money to

- Enter the amount

- Enter the reason you’re sending the money (optional)

- Set the privacy of the transaction (Prive, Friends, or Public)

- Select Pay (or Request) to request the amount from that person

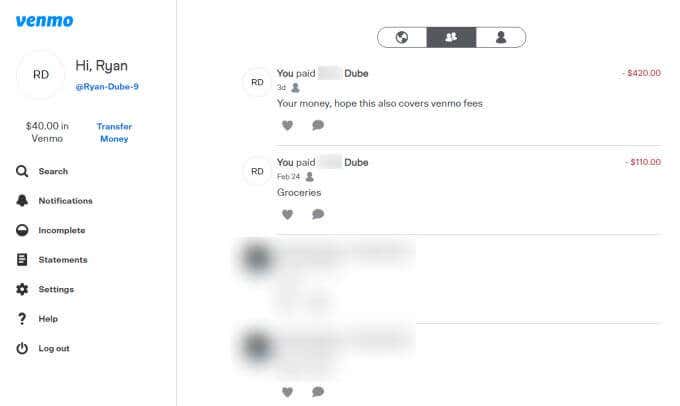

You’ll see this transaction appear on the main page of the app. You can tap that transaction at any time in the history to view the payment details.

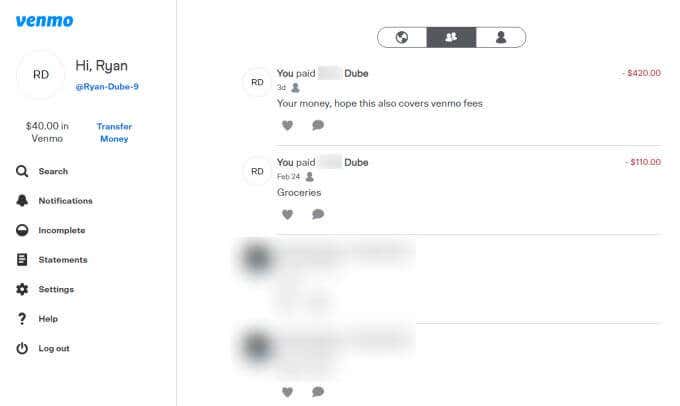

Transfer Money to Your Bank Account

Whenever someone sends you money, you’ll see that appear in your Venmo balance. At any time you like you can tap the Transfer Balance link at the top of the menu to transfer money to your bank account or credit card.

The Transfer Balance page will show your full balance available to transfer. You can do an instant transfer to your bank or credit card for a 1% fee, or allow it to take up to three days with no fee.

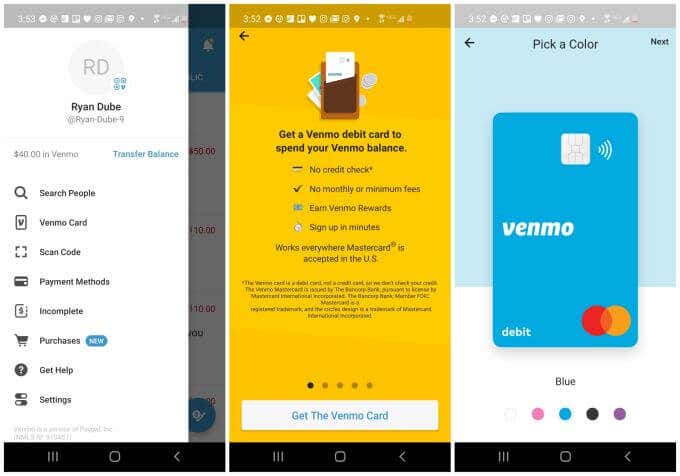

Get a Venmo Debit Card

You might have already heard about the Paypal debit card, which lets you access your Paypal funds instantly for payments at any offline or online store.

Now Venmo offers the same feature: the Venmo debit card.

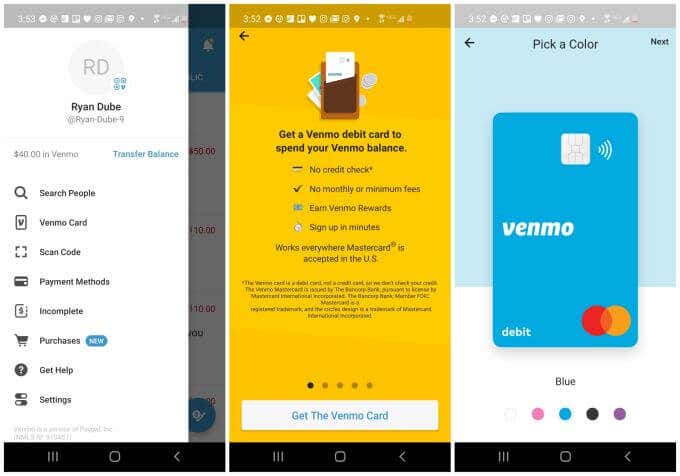

You can sign up for one by tapping Venmo Card in the app menu.

Just work through the wizard to sign up. You can choose from 4 basic colors. It’s a Mastercard debit card so works at mostly any business. It is also a Rewards card so you can earn points every time you use it – and there’s no credit check or monthly fees associated with it.

Venmo vs. Paypal: What Are the Differences?

You may have noticed that Venmo and Paypal have a lot in common. Other than a very different user interface, the two services are very similar.

One of the main differences is Venmo is almost like a payment service and social network combined into one. You can add friends on the service, which makes it more convenient to send or receive payments from them later.

Fees and Charges

There are a number of other differences, some slight and others significant. For example, here are the differences in fees.

- Venmo charges 3% for credit card payments; PayPal charges 2.9% plus a $0.30 fixed charge.

- No fees for bank transfers with either service.

- No fee for debit card payments with Venmo; Paypal charges 2.9% plus a $0.30 fixed charge.

- Venmo has a transaction limit of $4,999.99; Paypal only limits transactions at $10,000.

- Withdrawing money to your bank is faster with Venmo, which only takes 1-3 days. Paypal withdrawals can take from 3-5 days.

Which Is More Accessible?

You can access both services on the same platforms, including the mobile app, or both the mobile or desktop browsers. There is one big difference you’ll notice when you visit Venmo on a browser and log into your account.

You won’t see a Send or Request blue button on the lower right corner like you do in the app. This is because with Venmo, you can only send or request payments using the mobile app.

You can still use the website to review your transaction history, update settings, or request a transfer to your bank account or credit card.

Also, Venmo is only available for use within the United States. On the other hand PayPal is available to people in over 200 countries.

Paypal is also more commonly accepted across many online and offline businesses.

Venmo being much newer, is still getting a foothold.

Being able to pay for things directly in stores using these services means you don’t have to transfer money to your bank account before you can buy things with your balance.

Sending Money to People

Without a doubt, the process of sending money to people with Venmo is much simpler and more streamlined. Using the Venmo app, it’s really just a quick three step process without any confusing options or other choices.

If the user has a Venmo account, you type the amount, a reason (if you want), whether to share the transaction publicly, and you’re done. Your user will have to pay a fee for receiving the money but Venmo doesn’t bother you with those details.

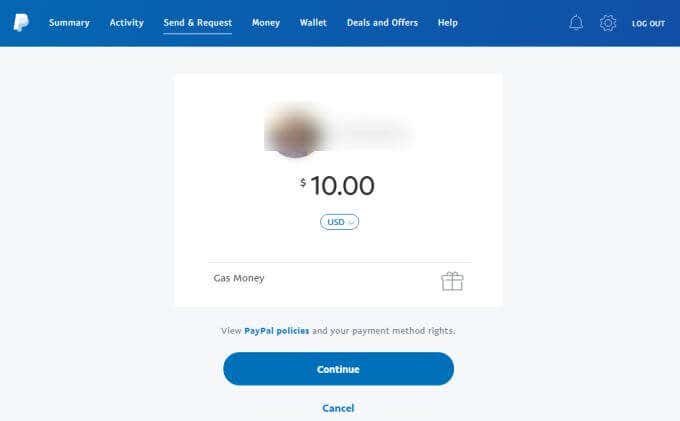

Paypal, on the other hand, has Send, Request, Crypto, and More buttons on the main page, mixed among all kinds of other information cluttered around the main dashboard. It’s also not very easy to find the link to transfer money to your bank or credit card.

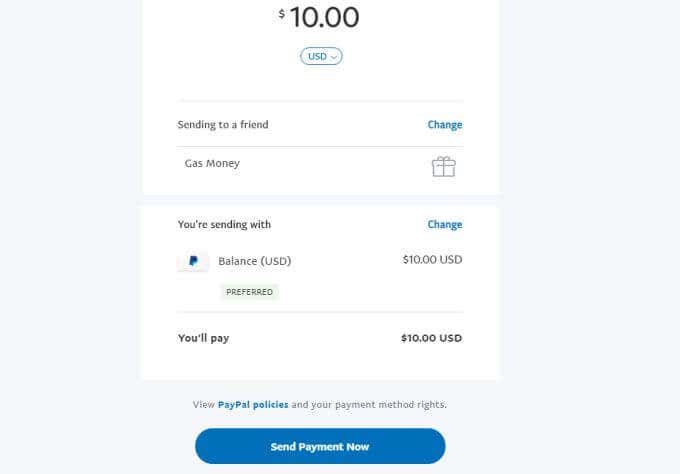

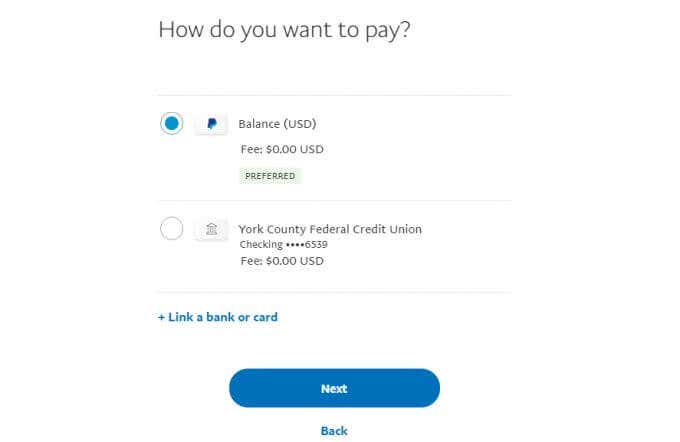

And once you do select Send, the process isn’t a simple form. It’s a step by step wizard that changes the next options depending on your choices and who you’re sending money to.

The first step of the wizard looks simple enough.

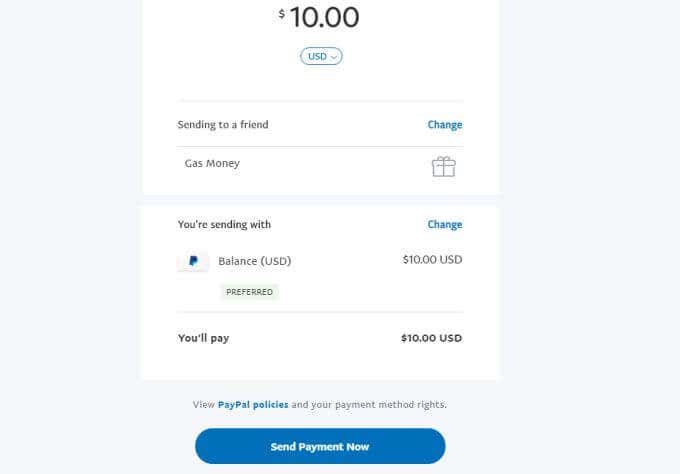

But then after you select Continue, you’ll see details of the transaction that apparently you can change, like currency, whether you’re Sending to a friend, and what account you’re sending with.

If you choose to change the account, you’ll see you can use your Paypal account or send directly from your bank account.

Why are there so many choices with Paypal while Venmo is such an easy 3-step process?

It’s because Paypal has layered in more complicated fee structures depending on whether payments are international, and what is being paid for.

For example if you’re sending money to a friend you can choose to pay the fee or have the recipient pay it. Or you can choose to pay for goods or services, in which case the recipient has to pay the fee and have it covered by Paypal Purchase Protection.

So, on the one hand, Paypal may offer more features and choices. But Venmo simplifies the entire transaction process by standardizing fees and other details, letting you finish the payment process in just a few, simple clicks.

Other Considerations

A few other important differences to take into account before you make your choice between Venmo vs. Paypal:

- Paypal offers Buyer Protection peace of mind when you’re purchasing from a business.

- Paypal offers business loans.

- You can buy or sell cryptocurrency with Paypal.

In comparing Venmo vs. Paypal, we used two full-membership accounts to examine the user interface, transaction process, features, fees, and balance transfers.

Ultimately, Venmo and Paypal do the same thing. They both get money out of your bank account or credit card and into someone else’s. The difference is that Paypal is a little bit more complicated to use, but offers many more features and services.

Venmo is best for someone who doesn’t want to deal with bells and whistles, and just wants a simple app to send someone some money as quickly and easily as possible.