资金(Money)管理是指一个人如何管理他的收入和支出以跟踪资金流向。有几种免费的个人理财软件(free personal finance software)和在线工具可以使资金管理过程更容易。本文列出了一些最好的免费在线资金管理工具或网站。使用这些免费工具,您可以跟踪您的日常开支。其中一些工具还提供有关您的收入和支出的详细图形报告。

最好(Best)的免费在线资金管理(Money Management)工具

我们有以下免费的在线资金管理工具或网站:

- 金钱爱好者

- 预算跟踪器

- 预算脉冲

- 好预算

- 梨预算

让我们看看所有这些免费工具的功能。

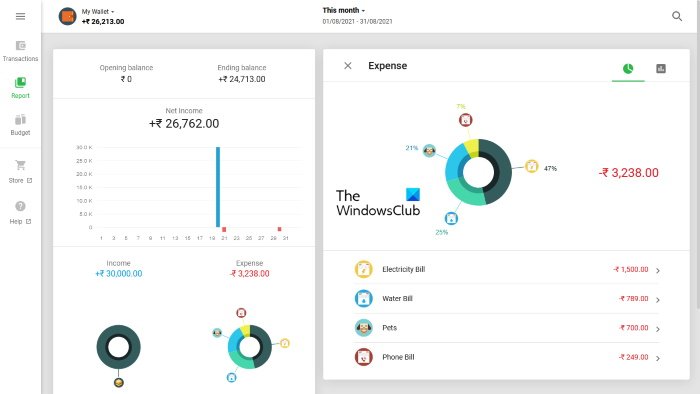

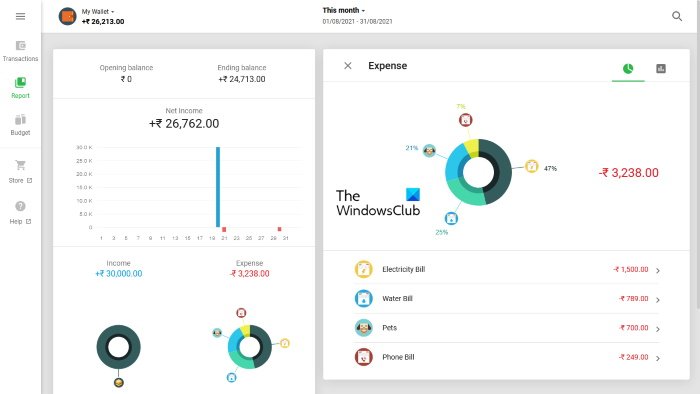

1]金钱爱好者

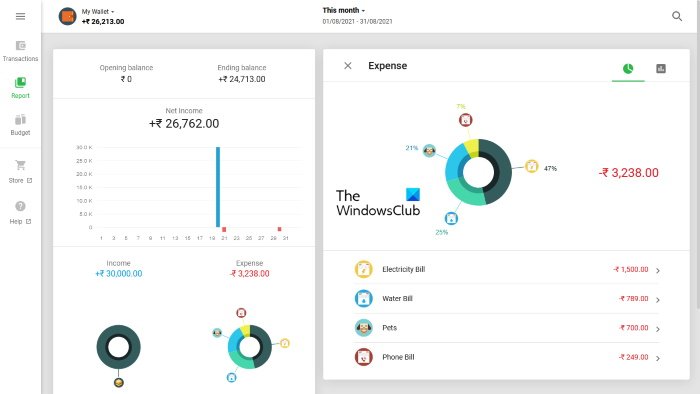

Money Lover是一个简单的在线资金管理工具,可让您记录您的收入和支出。该工具的免费版本只允许您将一个钱包添加到您的帐户。如果你想添加多个钱包,你必须购买他们的高级版本。首次在网站上注册时,您必须为您的钱包命名,选择您所在国家的货币,并将初始余额添加到钱包中。您也可以稍后在“我的钱包(My Wallets)”部分编辑这些选项。

Money Lover有一个简单易懂的界面。单击“(Click)交易(Transactions)”页面上的“添加交易(Add Transaction)”按钮。之后,为您的费用选择一个类别并输入您已花费的金额。您可以为当前、以前和即将到来的日期添加交易。您还可以为每笔交易添加注释。在更多详细信息(More Details)部分,您可以将位置、事件等添加到您的交易中。未来(Future)选项卡列出了所有即将发生的交易。

Money Lover的一些功能

让我们探索一下Money Lover的一些功能:

- 搜索交易(Search transaction):此功能可让您搜索特定交易。您还可以应用过滤器来获得更相关的搜索结果。

- 您可以上传账单和其他交易的图片。图像应为JPG、JPEG、PNG和GIF格式,并且大小小于 2 MB。

- 报告(Report):在这里,您可以查看当月、上月、去年、自定义日期范围等的收入和支出的图形表示。它以饼图和条形图格式显示图形数据。

要使用这个免费工具,您必须访问moneylover.me。

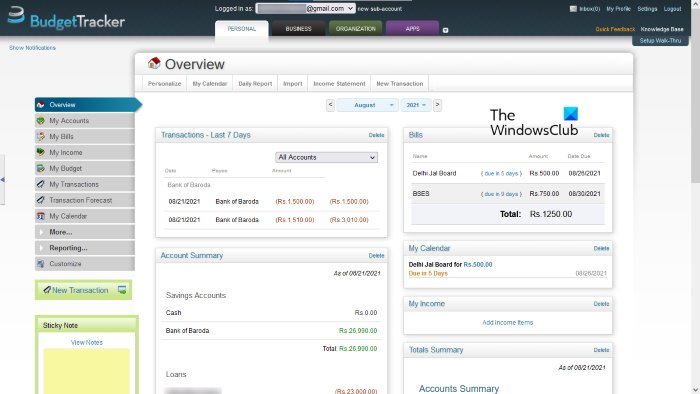

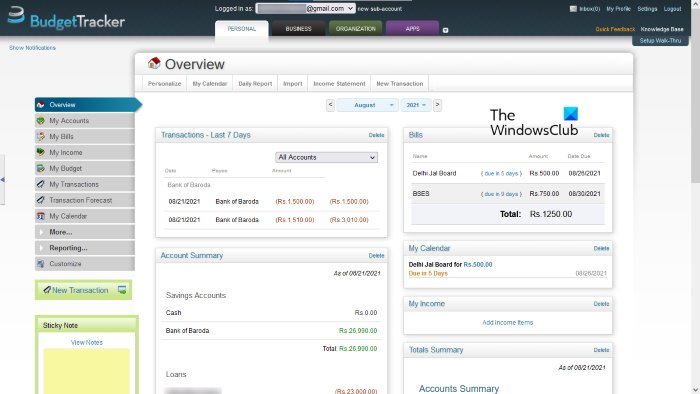

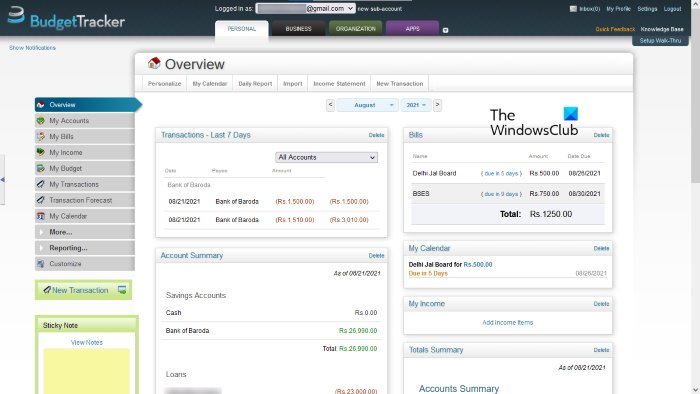

2]预算跟踪器

BudgetTracker是另一种工具,可让您在线管理收入和支出。它提供免费和付费版本。在免费版中,您最多可以添加 10 个银行账户。默认情况下,它以美元显示所有数据。您可以在设置(Settings)中更改此货币。如果您所在国家/地区的货币在列表中不可用,“新货币符号”选项可让您添加该货币。(New Currency Symbol)

首先,您必须添加您的银行帐户。为此,请转到“My accounts > New account”并填写必填字段。添加银行账户后,您可以向BudgetTracker添加不同的交易。对于每笔交易,您都可以选择一个特定的类别。如果所需类别在列表中不可用,您也可以添加新类别。但免费版仅限于 15 个类别。如果要添加超过 15 个类别,则必须升级您的会员资格。

BudgetTracker 的一些功能

BudgetTracker在其免费计划中提供了许多不错的功能。我们将在这里列出其中的一些功能。

- 我的账单(My Bills):在这里,您可以添加过期和即将到来的账单。您添加的所有账单都将显示在账单列表(Bills List)中。在免费计划中,您最多可以添加 10 张账单。

- 增加收入(Add income):此功能对拥有多个收入来源的人有利。此工具的免费版本可让您添加多达 10 个收入来源。

- 我的预算(My Budget):如果您有任何预算计划,可以在此处添加。

- 儿童预算(Kids Budgeting):这是一项高级功能,您可以在其中添加孩子的预算计划。但是在免费版本中,您只能将一个孩子添加到您的帐户中。

- 家庭库存(Home Inventory):BudgetTracker 带有免费的库存管理工具。您可以使用“家庭库存(Home Inventory)”部分添加家居用品的详细信息。

在报告(Reporting)部分,您可以查看您的预算报告、损益表、费用报告、资产负债表等。您无法打印报告摘要,也无法在免费版本中查看您的收入和支出的图形。

访问budgettracker.com使用这个免费的资金管理工具。

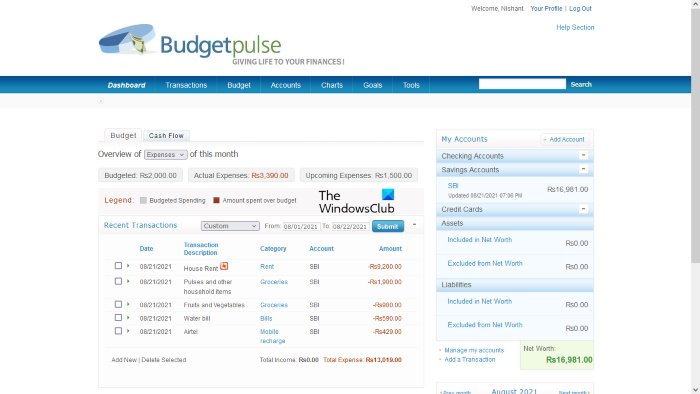

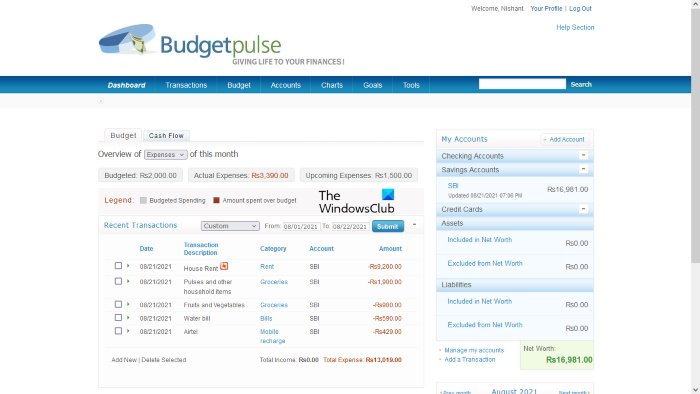

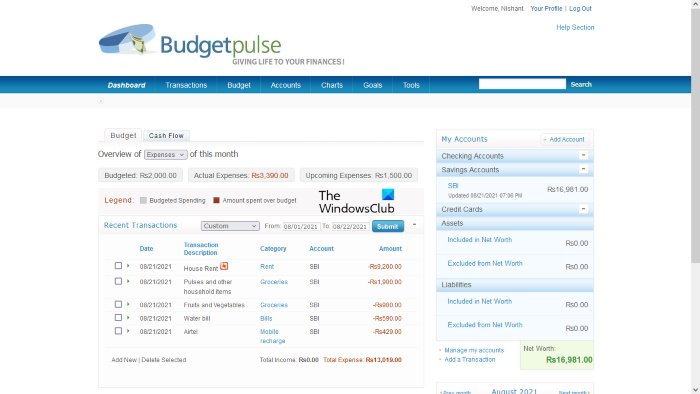

3]预算脉冲

Budgetpulse是另一种免费的在线资金管理工具。美元是此工具中的默认货币。您可以在个人资料设置中更改默认货币。首先,您必须将您的银行账户添加到Budgetpulse。为此,请转到仪表板(Dashboard),然后单击添加帐户(Add Account)按钮。同样,您也可以将您的Credit Cards、Assets和 Liabilities 添加到您的帐户中。

您可以在“交易(Transactions)”选项卡中添加交易详情、新类别、新标签和金额转账详情。Budgetpulse中没有可用的预添加类别。您必须自己创建所有类别。

Budgetpulse 的一些功能

让我们看一下Budgetpulse的一些功能:

- 您可以将过去、当前和即将发生的交易添加到您的帐户。除此之外,您还可以重复进行任何交易。当您必须像房租一样每月支付相同的金额时,此选项很有用。

- 您还可以拆分并为特定交易添加注释。

- 在预算(Budget)部分,您可以管理您的预算计划。

- Budgetpulse让您可以添加多个银行账户。

- Budgetpulse中也提供导出和导入选项。OFX、QFX、QIF和CSV是导入数据支持的文件格式。要使用这些选项,请单击工具(Tools)选项卡。

图表(Charts)选项卡显示您的收入、支出、收入和支出之间的比较、净资产和账户摘要的详细报告。导出到 PDF(Export to PDF)选项在图表选项卡中可用,但(Charts)它对我不起作用。

访问budgetpulse.com以跟踪您的收入和支出。

阅读(Read):Manager是一款免费的小型企业财务软件。

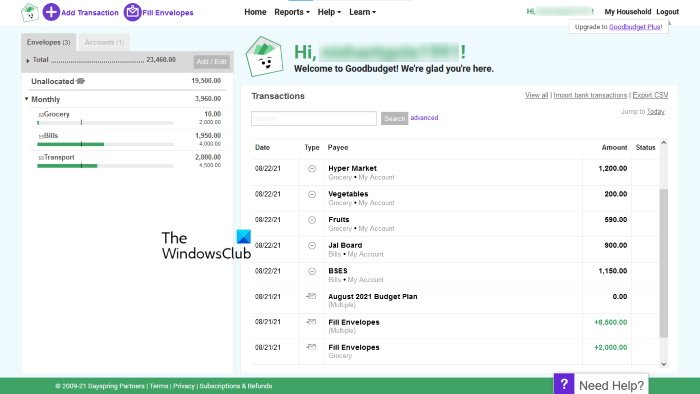

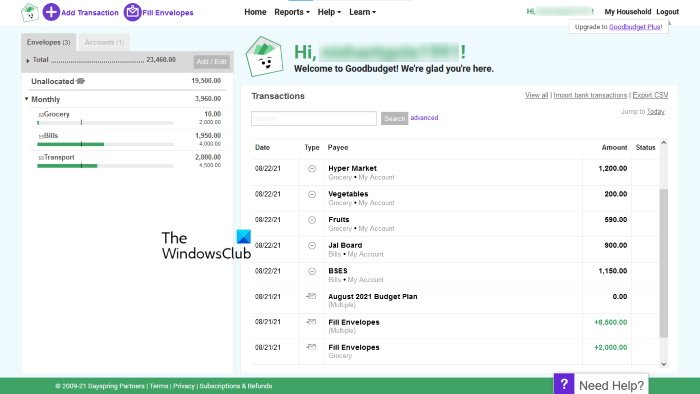

4] 好预算

Goodbudget允许您在其免费版本中仅添加一个银行账户。没有添加货币的选项。它仅以数值显示您的收入和支出,没有任何货币符号。您可以在Goodbudget(Goodbudget)中添加四种不同类型的交易,即:

- 费用/信用

- 汇款

- 收入

- 债务交易

在Goodbudget中,您可以通过添加信封来计划不同类别的每月预算。它的免费版本可让您添加多达 10 个普通信封和 10 个以上的信封。更多信封(More Envelopes)是一个高级部分,您可以在其中添加每 2 个月、3 个月、6 个月、每年等的预算。

如何使用好预算

让我们看看在Goodbudget中创建预算计划的过程。

- 首先(First),您必须添加您的银行帐户。为此,单击“帐户(Accounts)”选项卡,然后单击“Add/Edit”按钮。现在,添加您的银行账户名称和当前余额。

- 现在,您必须创建一些信封。为此,请转到主页(Home),然后单击信封(Envelopes)选项卡。现在,单击Add/Edit按钮添加新信封并编辑现有信封。单击(Click)“添加(Add)”按钮创建一个新信封。之后,输入您要分配给该信封的总金额。完成后,单击保存更改(Save Changes)。

- 创建所有信封后,您必须用分配的金额填充它们。转到主页(Home),然后单击填充信封(Fill Envelopes)。在“填充自”部分中,您可以在“(Fill from)未分配(Unallocated)”选项卡下命名您的预算。在填写您的信封(Fill your envelope)部分,输入每个信封的金额,该金额等于分配给该特定信封的金额。完成后,单击保存(Save)。

- 现在,您可以添加交易。为此,请转到主页(Home),然后单击添加事务(Add Transaction)。填写(Fill)所有详细信息,然后单击保存(Save)。

在报告(Reports)部分,您可以查看 8 种不同类型的报告,包括按信封(Envelope)支出(Spending)、按收款人(Payee)支出(Spending)、收入(Income)与支出(Spending)、债务进度(Debt Progress)、预算分配(Budget Allocation)等。

您可以将银行账户交易导入您的Godbudget账户。QFX、OFX和CSV是上传银行账户交易支持的文件格式。除此之外,该工具还允许您以CSV格式导出交易数据。

访问goodbudget.com以使用这个免费的在线工具。

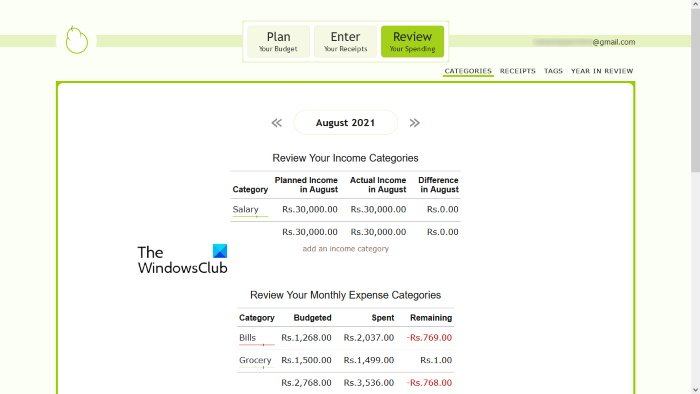

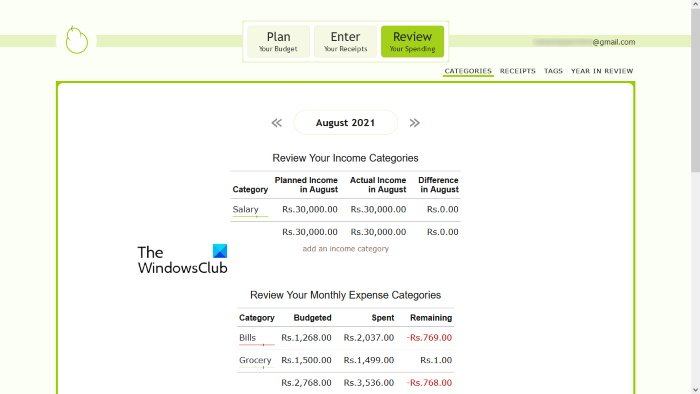

5]梨预算

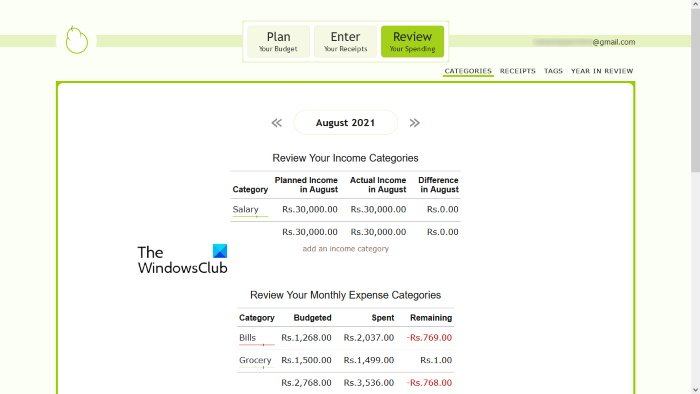

PearBudget是一个简单的资金管理工具,具有一些功能。在这里,您可以添加您的收入和支出,并计划您的预算。默认情况下,它不显示任何货币。您可以在帐户设置中添加您所在国家/地区的货币。

单击输入您的收据(Enter your Receipts)部分以输入您特定月份的收入和交易。对于每笔交易,您必须添加一个类别名称。您可以将每个类别名称标记为:

- 每月(Monthly)(余额不会每月结转)

- 不定期(Irregular)(每月结转余额)

- 收入

您还可以为每个类别创建多个标签。

您还可以按类别计划预算。如果您对特定类别的费用超过设定的预算,它将被标记为红色。查看您的支出(Review your Spending)部分包括您的收入和支出的详细报告。单击(Click)此部分下的年度回顾(Year in Review)选项卡以查看特定月份的收入和支出报告。

PearBudget中也提供了打印(PearBudget)报告(Print) 选项(report)。

访问pearbudget.com在线管理您的资金。

阅读(Read):TakeStock 2 是一款免费的个人投资管理软件(TakeStock 2 is a free Personal Investment Management software)。

如何在线跟踪我的资金?

您可以使用任何在线资金管理网站来跟踪您的资金。我们在本文中提到了一些免费的在线资金管理工具。您可以在任何这些网站上注册并免费管理您的费用和收入。

哪个应用程序最适合日常开支?

如果您搜索,您会在 Windows Store 上找到许多免费的个人理财和预算应用程序。这些应用程序以数字和图形形式详细分析您的月收入和支出。通过分析您的月度报告,您可以更好地规划预算。

就是这样。

阅读下一篇: 适用于 Windows 的(Read next: )免费个人财务和商业会计软件(Free Personal Finance & Business Accounting Software)。

Best free online Money Management tools

Money management refers to how a persоn manages his earnings and expenses to keep track of the monеy flow. There are severаl free personal finance software and online tools that make the process of money management easier. This article lists some best free online money management tools or websites. Using these free tools, you can keep track of your daily expenses. Some of these tools also provide a detailed graphical report of your earnings and expenses.

Best free online Money Management tools

We have the following free online money management tools or websites:

- Money Lover

- BudgetTracker

- Budgetpulse

- Goodbudget

- PearBudget

Let’s see the features of all these free tools.

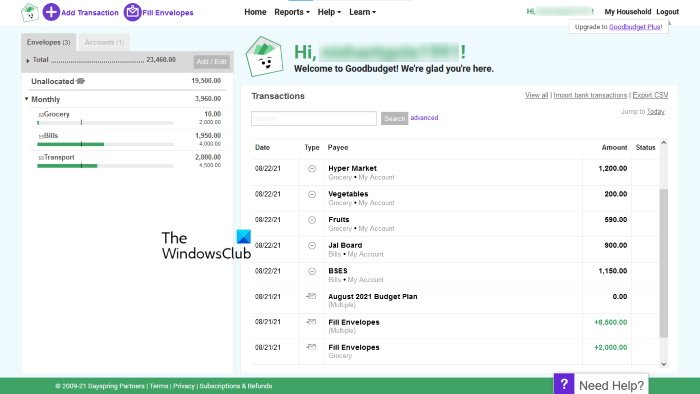

1] Money Lover

Money Lover is a simple online money management tool that lets you keep a record of your earnings and expenses. The free version of this tool allows you to add only one wallet to your account. If you want to add multiple wallets, you have to purchase their premium version. When you register on the website for the first time, you have to name your wallet, select the currency of your country, and add the initial balance to the wallet. You can also edit these options later in the My Wallets section.

Money Lover has a simple and easy-to-understand interface. Click on the Add Transaction button on the Transactions page. After that, select a category for your expense and enter the amount that you have spent. You can add transactions for the current, previous, and upcoming dates. You can also add a note to each transaction. In the More Details section, you can add location, event, etc., to your transaction. The Future tab lists all the upcoming transactions.

Some features of Money Lover

Let’s explore some of the features of Money Lover:

- Search transaction: This feature lets you search for a particular transaction. You can also apply filters to get more relevant search results.

- You can upload images of your bills and other transactions. The images should be in JPG, JPEG, PNG, and GIF formats and less than 2 MB in size.

- Report: Here, you can view the graphical representation of your income and expenses for the current month, last month, last year, custom date range, etc. It displays the graphical data in pie chart and bar graph formats.

To use this free tool, you have to visit moneylover.me.

2] BudgetTracker

BudgetTracker is another tool that lets you manage your earnings and expenses online. It is available in both free and paid versions. In the free version, you can add up to 10 bank accounts. By default, it displays all the data in US dollars. You can change this currency in the Settings. The New Currency Symbol option lets you add the currency of your country if it is not available in the list.

To begin, first, you have to add your bank account. For this, go to “My accounts > New account” and fill in the required fields. After adding your bank account, you can add different transactions to BudgetTracker. For every transaction, you can select a particular category. You can also add a new category if the required category is not available in the list. But the free version is limited to only 15 categories. If you want to add more than 15 categories, you have to upgrade your membership.

Some features of BudgetTracker

BudgetTracker offers a number of good features in its free plan. We will list some of these features here.

- My Bills: Here, you can add overdue and upcoming bills. All the bills that you add will be available in the Bills List. In the free plan, you can add up to 10 bills.

- Add income: This feature is beneficial for those who have more than one source of income. The free version of this tool lets you add up to 10 income sources.

- My Budget: If you have any budget plans, you can add them here.

- Kids Budgeting: It is an advanced feature where you can add your kid’s budget plans. But in the free version, you can add only one child to your account.

- Home Inventory: BudgetTracker comes with a free inventory management tool. You can use the Home Inventory section to add the details of your household items.

In the Reporting section, you can view your budget report, income statement, expense report, balance sheet, etc. You cannot print the report summary and view the graphical plot of your income and expenses in the free version.

Visit budgettracker.com to use this free money management tool.

3] Budgetpulse

Budgetpulse is one more free online money management tool. US dollar is the default currency in this tool. You can change the default currency in your profile settings. To begin, you have to add your bank account to the Budgetpulse. For this, go to Dashboard and then click on the Add Account button. Similarly, you can also add your Credit Cards, Assets, and Liabilities to your account.

You can add transaction details, new categories, new tags, and amount transfer details in the Transactions tab. There is no pre-added category available in Budgetpulse. You have to create all the categories on your own.

Some features of Budgetpulse

Let’s have a look at some features of Budgetpulse:

- You can add past, current, and upcoming transactions to your account. Apart from that, you can also make any transaction recurring. This option is useful when you have to pay the same amount every month like house rent.

- You can also split and add a note to a particular transaction.

- In the Budget section, you can manage your budget plans.

- Budgetpulse lets you add more than one bank account.

- Export and import options are also available in Budgetpulse. OFX, QFX, QIF, and CSV are the supported file formats to import data. To use these options, click on the Tools tab.

The Charts tab shows a detailed report of your income, expenses, a comparison between your income and expenses, net worth, and account summary. The Export to PDF option is available in the Charts tab, but it did not work for me.

Visit budgetpulse.com to keep a track of your income and expenses.

Read: Manager is a free financial software for small businesses.

4] Goodbudget

Goodbudget lets you add only one bank account in its free version. There is no option to add currency. It displays your income and expenses only in numerical value without any currency symbol. You can add four different types of transactions in Goodbudget, namely:

- Expense/Credit

- Money transfer

- Income

- Debt transaction

In Goodbudget, you can plan your monthly budget for different categories by adding envelopes. Its free version lets you add up to 10 regular envelopes and 10 more envelopes. The More Envelopes is an advanced section where you can add your budget for every 2 months, 3 months, 6 months, annually, etc.

How to use Goodbudget

Let’s see the process of creating a budget plan in Goodbudget.

- First of all, you have to add your bank account. For this, click on the Accounts tab and then click Add/Edit button. Now, add your bank account name and current balance.

- Now, you have to create some envelopes. For this, go to Home and then click on the Envelopes tab. Now, click on the Add/Edit button to add new envelopes and edit the existing ones. Click on the Add button to create a new envelope. After that, enter the total amount that you want to allocate to that envelope. When you are done, click Save Changes.

- After creating all the envelopes, you have to fill them with the amount that you have allocated. Go to Home and then click Fill Envelopes. In the Fill from section, you can name your budget under the Unallocated tab. In the Fill your envelope section, enter the amount to each envelope equal to the amount allocated to that particular envelope. When you are done, click Save.

- Now, you can add transactions. To do so, go to Home and then click Add Transaction. Fill in all the details and click Save.

In the Reports section, you can view 8 different types of reports, including Spending by Envelope, Spending by Payee, Income vs Spending, Debt Progress, Budget Allocation, etc.

You can import bank account transactions to your Godbudget account. QFX, OFX, and CSV are the supported file formats to upload bank account transactions. Apart from that, the tool also lets you export your transaction data in CSV format.

Visit goodbudget.com to use this free online tool.

5] PearBudget

PearBudget is a simple money management tool that comes with a few features. Here, you can add your income and expenses, and plan your budgets. By default, it does not display any currency. You can add your country’s currency in your account settings.

Click on the Enter your Receipts section to enter your income and transactions for a particular month. For each transaction, you have to add a category name. You can mark each category name as:

- Monthly (balance doesn’t carry over each month)

- Irregular (balance carries over each month)

- Income

You can also create multiple tags for each category.

You can also plan your budget category-wise. If your expense for a particular category exceeds the set budget, it will be marked with a red color. The Review your Spending section includes a detailed report of your earnings and expenses. Click on the Year in Review tab under this section to view your income and expenses report for a particular month.

The Print report option is also available in PearBudget.

Visit pearbudget.com to manage your money online.

Read: TakeStock 2 is a free Personal Investment Management software.

How can I keep track of my money online?

You can use any online money management website to keep track of your money. We have mentioned some of the free online money management tools in this article. You can register on any of these websites and manage your expenses and earnings for free.

Which app is the best for daily expenses?

If you search, you will find many free personal finance and budgeting apps on Windows Store. These apps provide a detailed analysis of your monthly earnings and expenditure in both numerical and graphical forms. By analyzing your monthly reports, you can plan your budget better.

That’s it.

Read next: Free Personal Finance & Business Accounting Software for Windows.