大数据(Big Data)(结构化和非结构化)颠覆了投资组合经理现在衡量其投资组合中所涉及风险的方法。其中许多使用预测分析来预测结果。也就是说,来自领先品牌的越来越多的软件程序使选择变得有些困难。Zoom 投资组合管理器(Zoom Investment Portfolio Manager)简化了这项任务。

Zoom 投资组合经理

理想的投资组合经理应该利用可用资源有效地实施正确的投资组合策略。此外,它应该支持信息的实时准确性,并具有直观、易于学习的工具集。Zoom 投资组合管理器(Zoom Investment Portfolio Manager)在一个软件包中提供所有这些好处。它可用于管理您对股票、股票和基金的投资。

该工具的一个特殊特点是,与将信息存储在云或某些服务器中的基于 Web 的投资组合不同,Zoom将数据存储在您的计算机上,从而对其保密。

此外,它还可以让您同时管理多个投资组合。如果需要,您可以访问每个投资组合及其交易的详细视图。

建立一个新的投资组合

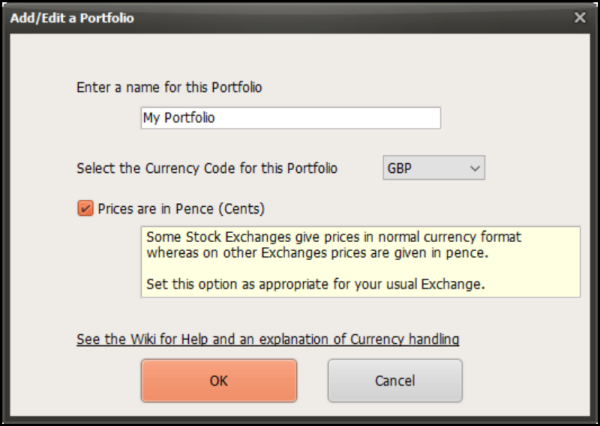

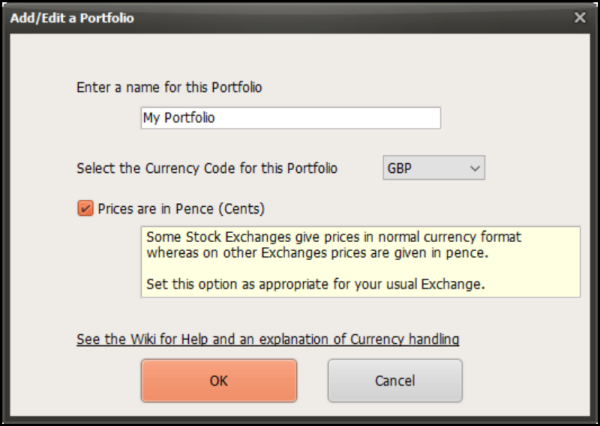

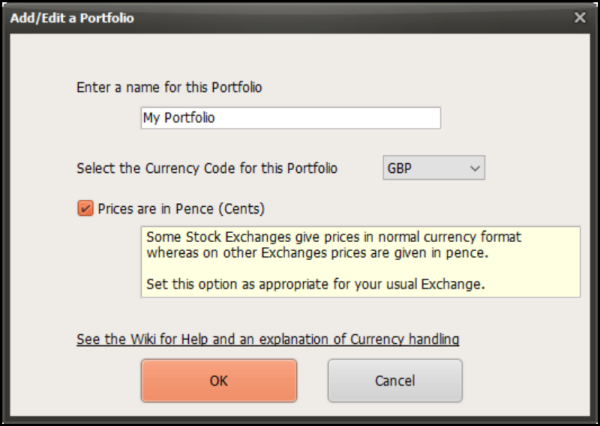

您可以通过创建新的投资组合重新开始。只需(Simply)输入有关名称的必要详细信息并选择货币。您应该为每个投资组合设置货币以及是否“以便士为单位的价格”。此外,您必须在投资组合管理器(Portfolio Manager)选项中设置您当地的(Options)货币代码(Currency Code)。例如,

- USD = 美元

- GBP = GB 英镑等

现在,如果您持有上述货币以外的货币投资,请为每种货币创建一个单独的投资组合,并在该投资组合中设置正确的外币符号。

同样,在输入购买和销售外国投资时,您应该以当地货币输入成本、收益、佣金和税额。这是一种尝试,以正确无忧地计算年度纳税申报表的资本收益。(Tax Return)

设置完成后,您就可以将交易添加到您的投资组合中了。目前,支持以下类型的资金交易,

- 买

- 卖

- 分裂

可以通过买入(Buy)或卖出(Sell)选项支持其他类型的交易。

明确定义您的投资头寸后,继续操作并单击底部可见的“研究标签”以获取有关您持股的在线信息。(Research tab’)

您可以完全控制您的投资概况。您可以配置与以下相关的不同选项

- 销售职位

- 检查价格的任何更新

- 调整现金余额

- 将所选头寸移至另一个投资组合

- 获取每个投资组合的完整摘要,其中包含有关总成本、收益等的详细信息。

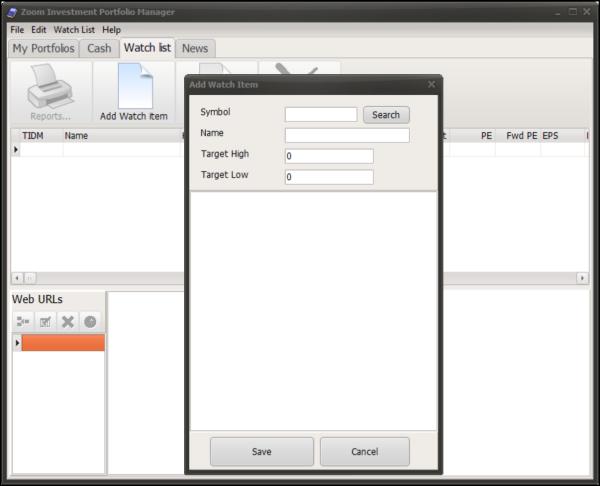

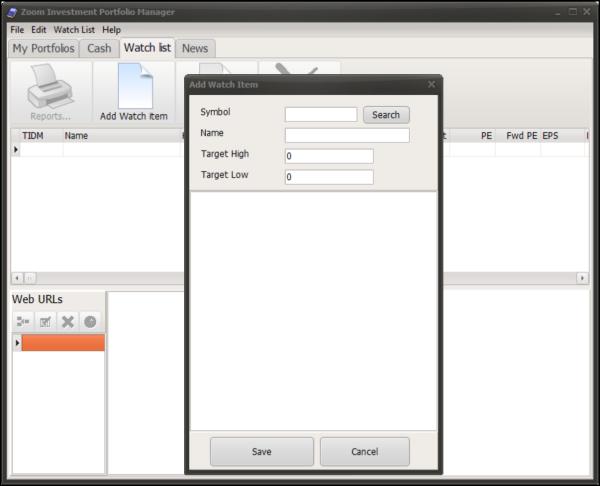

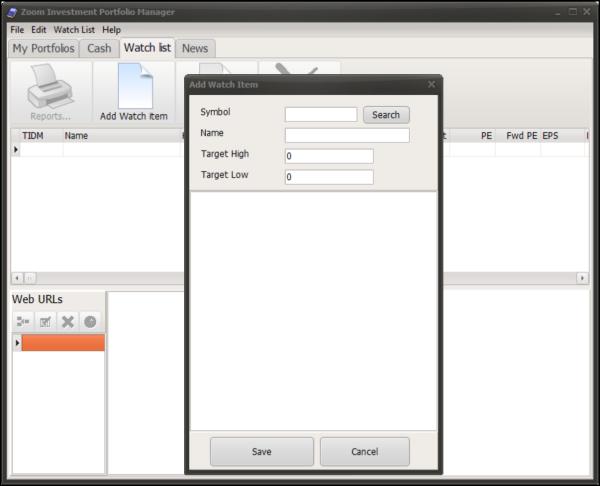

除了上述功能外,Zoom Investment Portfolio Manager还允许您创建一个“观察列表(Watchlist)”,帮助您在做出投资决策或在市场关闭时对潜在投资进行一些研究之前比较投资。

在Watchlist选项卡下,您可以指定与公司相关的不同方面,例如高(High)目标、低(Low)目标、PE 等。

最后,有一个现金会计选项卡。它提供了根据投资组合现金余额调整的所有(Portfolio)购买(Purchases)和销售的完整概览,跟踪您的未投资现金。默认情况下,它提供双模式

简单模式(Simple mode)– 在这里,您只需在现金调整(例如股息或提款)更改余额时更正余额。

详细的现金视图(Detailed Cash View)——您可以输入个人股息和其他收款或付款。

您可以随时在“简单”和“详细”模式之间切换。

Zoom Investment Portfolio Manager为各种头寸生成的报告,包括有关交易和股息的详细信息,可以导出为CSV文件格式。

如果您认为您需要一个免费的投资组合管理器软件,您可能需要检查一下。您可以从sourceforge.net下载它。

TakeStock 2是另一个您可能想要查看的免费个人投资管理软件。(TakeStock 2 is another free Personal Investment Management software you may want to check out.)

Zoom Investment Portfolio Manager for Windows 10

Big Data (both structured and unstructured) has disrupted the methods by which portfolio managers now measure risks involved in their investment portfolio. Many of these use predictive analysis to anticipate an outcome. That said, an ever-increasing number of software programs from leading brands have made a choice somewhat difficult. Zoom Investment Portfolio Manager simplifies this task.

Zoom Investment Portfolio Manager

An ideal investment portfolio manager should effectively implement right portfolio strategies by using the available resources. Besides, it should support the real-time accuracy of information and feature intuitive, easy-to-learn toolset. Zoom Investment Portfolio Manager offers all these benefits in a single package. It can be used to manage your investments in stocks, shares, and funds.

A special characteristic of this tool is that unlike web-based portfolios that store information in the cloud or some servers, Zoom, stores data on your computer and thus keep it confidential.

Moreover, it lets you manage more than one portfolio simultaneously. If required, you can access the detailed view of the of each portfolio alongside their transactions.

Set up a new portfolio

You can start afresh by creating a new portfolio. Simply enter the necessary details about the name and select the currency. You should set the currency for each portfolio and whether “Prices in pence”. Also, you must set your local Currency Code in the Portfolio Manager Options. For example,

- USD = US Dollar

- GBP = GB Pound Sterling etc

Now, if you hold investments in currencies other than the ones mentioned above then, create a separate Portfolio for each currency and set the correct foreign currency symbol in that portfolio.

Likewise, when entering purchases and sales of foreign investments, you should enter the cost, proceeds, commission and tax amounts in your local currency. This is an attempt to make the process of calculating your capital gains for your annual Tax Return correctly and in a hassle-free way.

Once set up, you are ready to add transactions to your portfolios. Currently, Following types of capital transaction are supported,

- Buy

- Sell

- Split

Other types of transaction can be supported through Buy or Sell options.

Once your investment positions are defined clearly, proceed further and click the ‘Research tab’ visible at the bottom to get online information about your holdings.

You have complete control over your investment profile. You can configure different options related to

- Selling Positions

- Checking for any updates in prices

- Adjusting cash balance

- Moving the selected position to another portfolio

- Getting a complete summary of each portfolio with details about the total cost, gain, etc.

In addition to the above-discussed features, Zoom Investment Portfolio Manager lets you create a ‘Watchlist’ that helps to compare investments before making investment decisions or doing a bit of research in potential investments when markets are closed.

Under the Watchlist tab, you can specify different aspects related to a company, such as High target, Low target, PE, etc.

Lastly, there’s a cash accounting tab. It offers a complete overview of all the Purchases and sales adjusted on the Portfolio cash balance, keeping track of your uninvested cash. By default, it offers dual mode

Simple mode – here, you just need to correct the balance when it is changed by cash adjustments (such as dividends or withdrawals).

Detailed Cash View – you can enter individual dividends and other receipts or payments.

You can switch between “Simple” and “Detailed” mode at any time.

The reports generated by Zoom Investment Portfolio Manager for various positions including details about the transactions and dividends can be exported to CSV file format.

If you think you need a free portfolio manager software, you may want to check it out. You can download it from sourceforge.net.

TakeStock 2 is another free Personal Investment Management software you may want to check out.