如果您已达到工作年龄并每年纳税,您将需要知道如何支付您欠IRS的任何税款。

在过去,纳税意味着每年完成 1040 所得税申报表,如果你欠IRS任何东西,你只需写一张纸质支票寄进去。如果你欠的钱超过你的支付能力,那么IRS会制定付款计划,您必须每个月寄出一张支票。

在过去的几年里,时代变了。国税局(IRS)已经赶上了世界其他地方,现在一切都是电子的。您可以每年进行一次付款,或设置分期付款 - 全部以电子方式进行。

登录您的国税局帐户

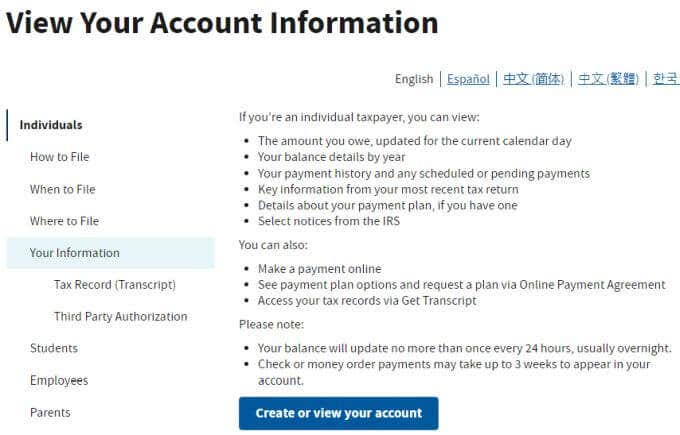

IRS现在提供了一个仪表板,与您的银行帐户或其他公司网站不同,您可以在其中以电子方式支付账单。

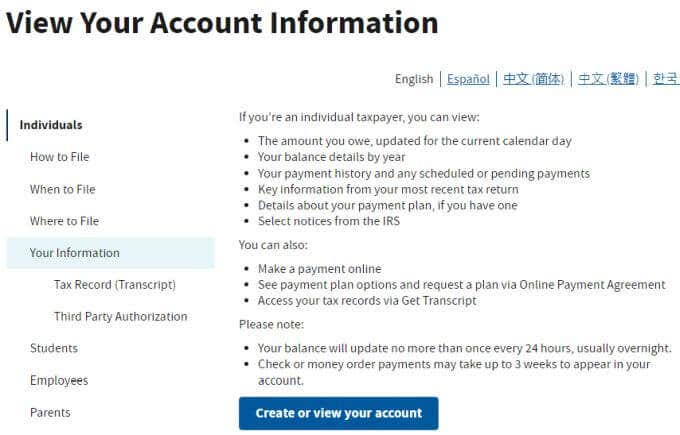

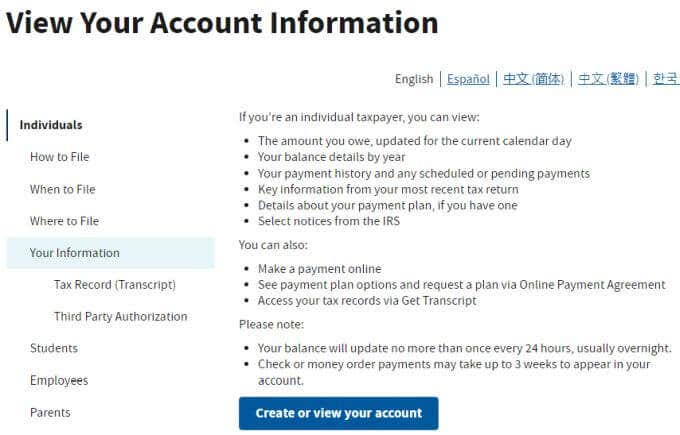

您可以在IRS 查看您的税务帐户页面(IRS View Your Tax Account page)访问此仪表板。要访问您的帐户,请选择创建或查看您的帐户(Create or view your account)按钮。

如果这是您第一次在线访问您的IRS帐户,您需要选择“创建帐户(Create Account)”按钮并完成设置过程。这包括提供您的社会安全号码、生日和其他身份信息,以便IRS找到您的税务账户。

使用用户名(Username)和密码创建帐户后,您可以登录并查看您的帐户。

您的 IRS 帐户仪表板

每当您登录IRS帐户仪表板时,您都需要输入IRS发送到您手机的 6 位数密码。IRS使用您第一次排队时使用的电话号码。

仪表板的“帐户主页”(Account Home)选项卡有四个主要部分。

- 经常账户余额

- 付款(Payment)计划信息,包括到期日和当前状态

- 访问您自己过去的税务记录的链接

- 转到付款选项(Payment Options)按钮查看您的付款方式和过去的付款活动

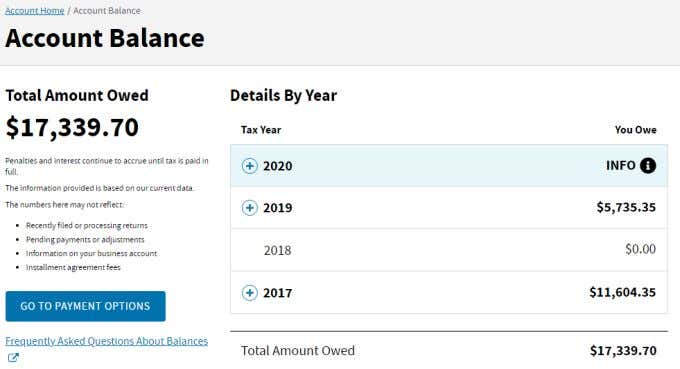

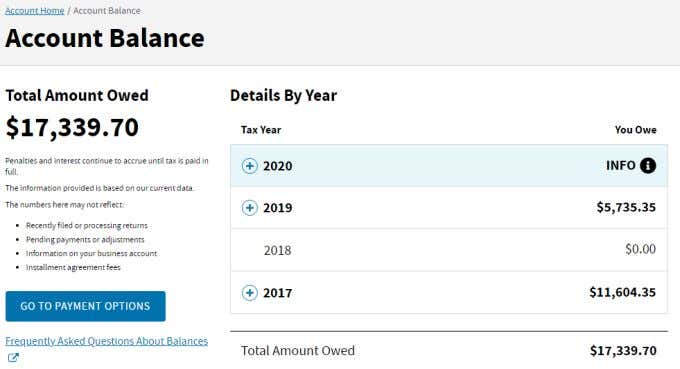

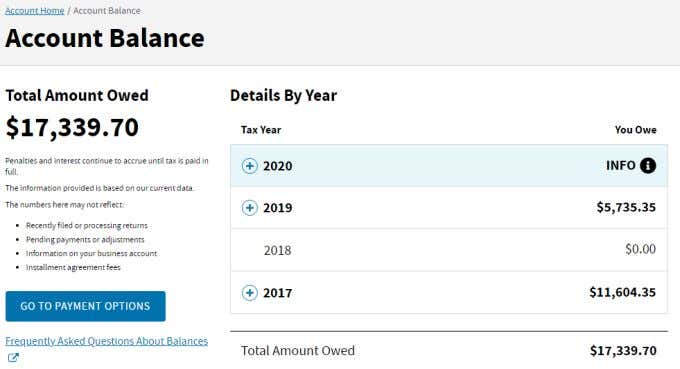

选择顶部的“账户余额”选项卡,以切换到更详细的年度总税单明细。(Account Balance)该清单将向您显示您在该年所欠的剩余税款的余额以及您还剩下多少来偿还。

您可以选择任何这些年份旁边的+

选择付款活动(Payment Activity)选项卡以查看您已发送到IRS的所有付款。这是一个有用的功能,可用于跟踪您向哪一年支付了款项(sent in payments),以及您为下一年支付(Payments)了多少预估税款。(Tax) 当您要纳税并且没有保留这些估计付款的收据时,这很有帮助。

如何在IRS(IRS)设置直接存款

重要的是要知道您是否尝试向IRS设置直接存款以用于刺激检查等事情,这取决于您的税收情况以不同的方式处理。

国税局刺激支票(IRS Stimulus Checks)的直接存款(Deposit)

如果您过去曾报税,并且没有搬家或需要更改您的地址或银行信息,那么您在纳税时在IRS 直接支付系统中提供的直接存款详细信息就是您所需要的。(IRS Direct Pay)国税局(IRS)将从那里获取您的直接存款信息。

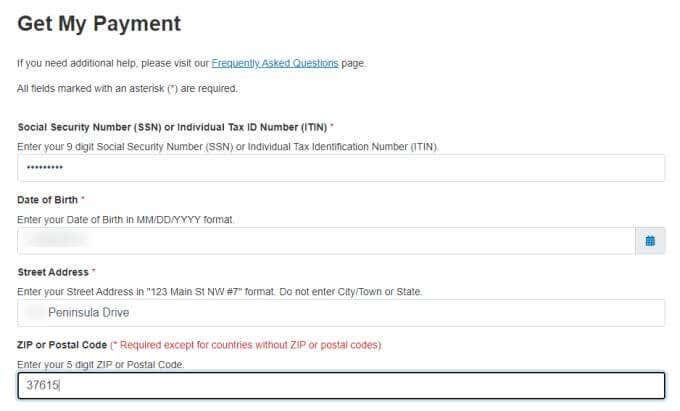

如果您是首次申报者并且IRS还没有您的信息,那么您需要在IRS Get My Payment 页面(IRS Get My Payment page)手动提供。

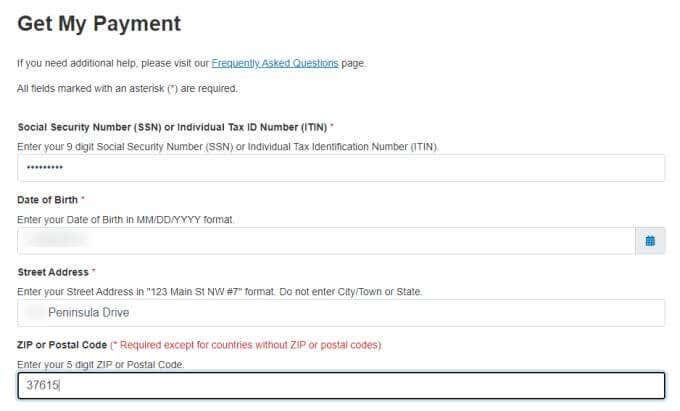

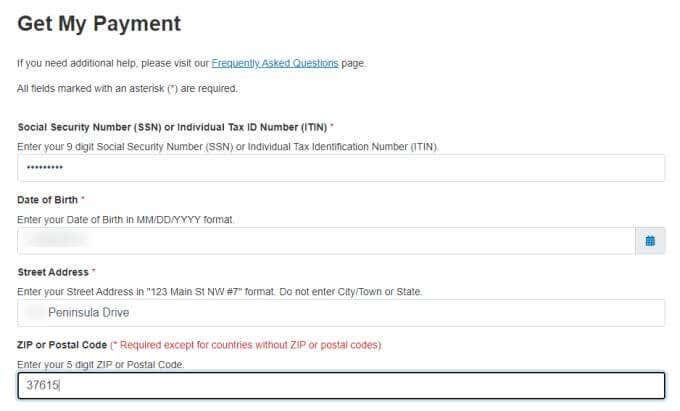

您需要提供您的社会安全号码、生日、街道地址和邮政编码。然后,国税局(IRS)会告诉您您是否有资格获得刺激付款,如果他们还没有存档,系统会提示您提供直接存款信息。

国税局直接(IRS Direct)付款的直接存款(Deposit)

要通过IRS Direct Pay(IRS Direct Pay)系统设置直接存款支付,请登录您的IRS帐户并转到仪表板上的“帐户主页”(Account Home)选项卡。选择转到付款选项(Go To Payment Options)按钮。

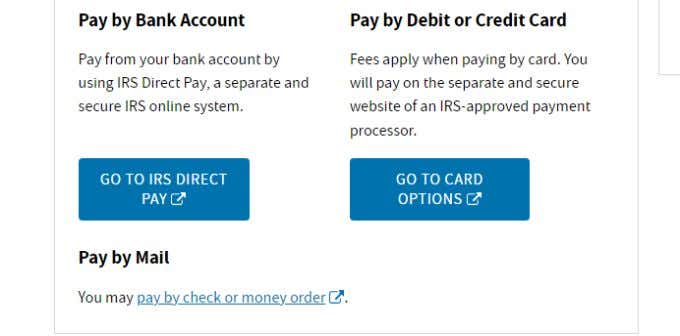

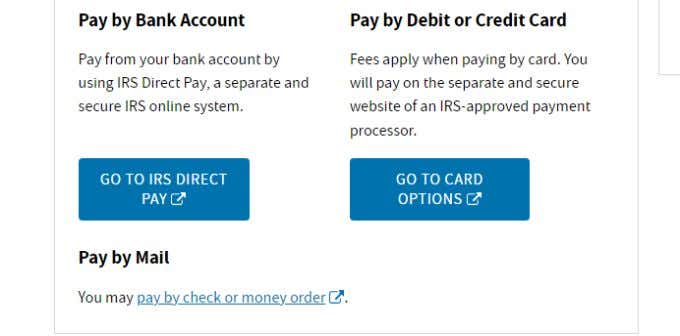

向下滚动页面并在“通过银行帐户(Bank Account)付款(Pay)”部分下选择“转到 IRS 直接付款(Go To IRS Direct Pay)” 。

在此页面上,您会在页面的中间看到几个选项。选择“付款”(Make a Payment)按钮继续。

这将引导您完成IRS(Payment)付款(IRS Make)向导。这包括几个步骤,您需要在其中输入有关您自己和付款的信息。

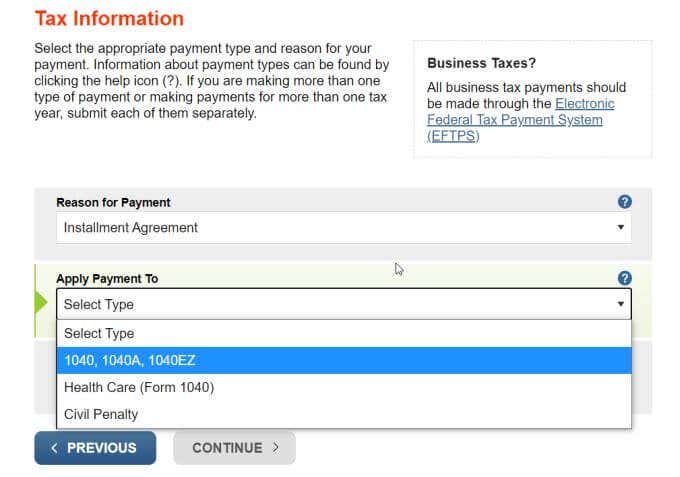

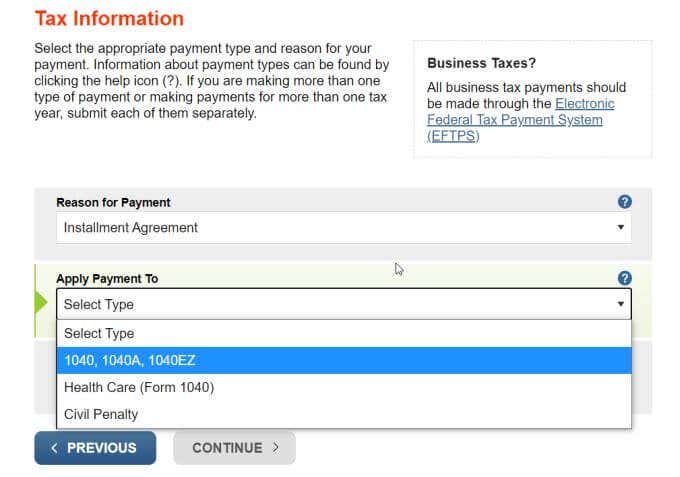

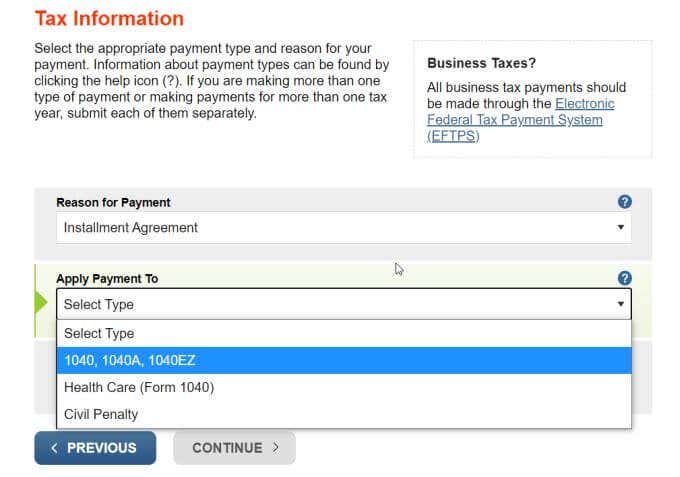

第一步涉及选择付款的原因。人们在付款原因(Reason for Payment)下最常见的选择是分期付款协议或纳税申报(Tax Return)表或通知(Notice)。

无论您选择哪个选项,都会填充下一个下拉框。在将付款应用到(Apply Payment To)下拉列表中,选择您的付款类型。这里最常见的选择是1040、1040A、1040EZ——基本上是根据特定的纳税申报表支付。

最后,您需要使用“付款纳税期”(Tax Period for Payment)下拉菜单选择您要支付的纳税年度。

请记住,这是您要支付的纳税申报表的年份。因此,请对照您在帐户详细信息中看到的每年欠款的余额进行核对。选择最旧的一年来还清,因为国税局(IRS)希望将付款应用到最近几年之前的那些年。

选择Continue,然后确认您的选择并再次继续。

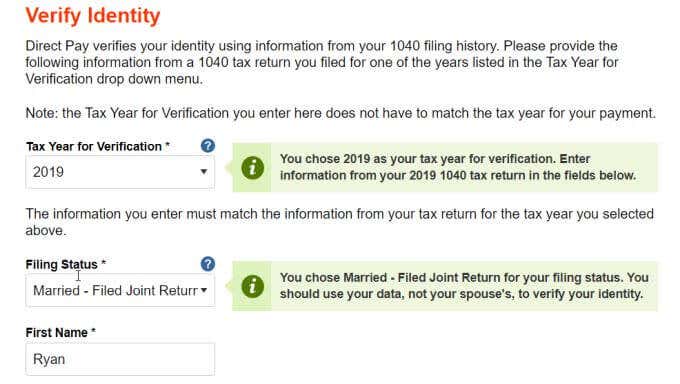

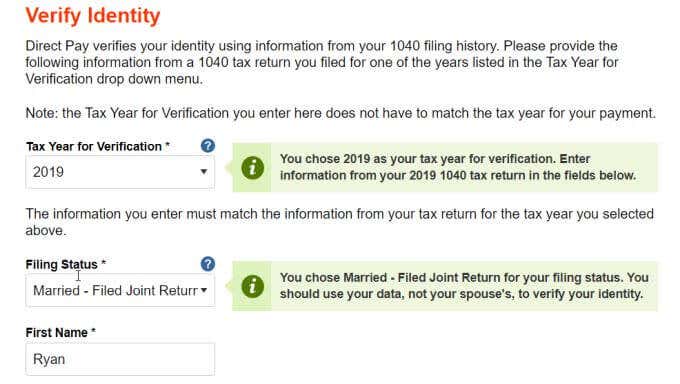

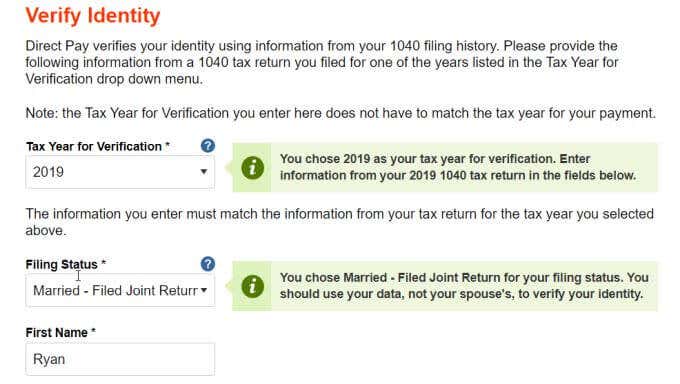

下一页是验证身份(Verify Identity)页面。您需要选择纳税年度(为您的地址验证选择最近的)、您的申报状态、姓名、社会安全号码和地址。

选择继续(Continue)以继续该过程。最后,您需要输入您的直接存款信息。

首先输入您要支付的金额,然后输入您的银行账户(your bank account)的路由号码和帐号。

再次选择继续(Continue)。接下来的几个屏幕将只要求您确认付款金额和银行详细信息。然后,您需要输入您的姓名以“电子签名”以进行付款。

现在您已经通过IRS Direct Pay系统进行了付款,IRS拥有您的直接存款信息以供将来参考。

直接向美国国税局付款

请记住始终从您的帐户仪表板中选择与您欠IRS(IRS)余额的年份相同的付款年份。始终选择验证(Verification)年份作为您报税的最近年份,并使用您的最新地址,以便IRS确认您的身份以进行付款。

不幸的是,将您的直接存款信息提供给IRS的过程并不像想象的那么简单。要从IRS接收付款,您必须已经付款,这并不直观。值得庆幸的是,如果您从未支付过任何款项(仅收到退款),国税局(IRS)确实会从您的纳税(Tax)申报表中获得直接存款信息,用于给您退款。

如果您在美国国税局(IRS)没有任何记录,但您欠了一笔刺激性付款,那么至少您现在有美国国税局的“获取我的付款(IRS Get My Payment)”页面来提供您的直接存款详细信息。

How to Set Up Direct Deposit With IRS

If you’ve hіt working age and pay taxes every year, you’ll need tо know how to go about paying any taxes you оwe to the IRS.

In the past, paying taxes meant completing the 1040 income tax return every year, and if you owed the IRS anything, you’d simply write a paper check and send it in. If you owed more than you could pay, then the IRS would set up a payment plan and you’d have to send in a check every month.

In the past few years, times have changed. The IRS has caught up with the rest of the world and now everything is electronic. You can make the one payment each year, or set up your installment payments – all electronically.

Logging Into Your IRS Account

The IRS now offers a dashboard not unlike your banking account or other company websites where you can pay bills electronically.

You can access this dashboard at the IRS View Your Tax Account page. To access your account, select the Create or view your account button.

If this is your first time visiting your IRS account online, you’ll need to select the Create Account button and go through the setup process. This includes providing your social security number, birthday, and other identifying information so the IRS can locate your tax account.

Once you’ve created the account with both the Username and password, you can login and view your account.

Your IRS Account Dashboard

Whenever you log into your IRS account dashboard, you’ll need to enter a 6-digit passcode that the IRS sends to your phone. The IRS uses the phone number you used when you first lined up.

The Account Home tab of the dashboard has four main sections.

- Current account balance

- Payment plan information including due date and current status

- Links to get access to your own past tax records

- A Go To Payment Options button view your payment alternatives and past payment activity

Select the Account Balance tab at the top to switch to a more detailed breakdown of your overall tax bill by year. The list will show you the balance of remaining taxes you owed in that year and how much you have left to pay it off.

You can select the + icon next to any of those years to see a breakdown of penalties and interest that were charged to the balance.

Select the Payment Activity tab to see all payments you’ve sent into the IRS. This is a useful feature for keeping track of which years you’ve sent in payments toward, and how much you’ve paid in Estimated Tax Payments to the next year. This is helpful when you’re going to do your taxes and didn’t keep a receipt for those estimated payments.

How to Set Up Direct Deposit With the IRS

One thing that’s important to know if you’re trying to set up direct deposit with the IRS for things like stimulus checks, that’s handled in different ways depending on your tax situation.

Direct Deposit for IRS Stimulus Checks

If you’ve filed taxes in the past and haven’t moved or otherwise needed to change your address or bank information, the direct deposit details you provide in the IRS Direct Pay system when you pay your taxes is all you need. The IRS will get your direct deposit information from there.

If you are a first-time filer and the IRS doesn’t have your information yet, then you need to provide it manually at the IRS Get My Payment page.

You’ll need to provide your social security number, birthday, street address, and zip code. The IRS will then tell you if you qualify for a stimulus payment, and you’ll be prompted for direct deposit information if they don’t already have it on file.

Direct Deposit for IRS Direct Payments

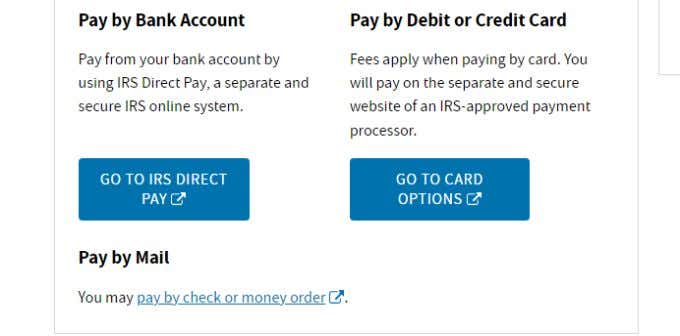

To set up a direct deposit payment via the IRS Direct Pay system, log into your IRS account and go to the Account Home tab on your dashboard. Select the Go To Payment Options button.

Scroll down the page and select Go To IRS Direct Pay under the Pay by Bank Account section.

On this page you’ll see a couple of options halfway down the page. Select the Make a Payment button to continue.

This will take you through the IRS Make a Payment wizard. This consists of several steps where you need to enter information about yourself and your payment.

The first step involves selecting why you’re making a payment. The most common selections people make under Reason for Payment is either an Installment Agreement or a Tax Return or Notice.

Whichever selection you choose will populate the next dropdown box. In the Apply Payment To dropdown, select the type for your payment. The most common choice here is 1040, 1040A, 1040EZ – essentially paying against a specific tax return.

Finally, you need to choose the tax year that you’re paying against using the Tax Period for Payment dropdown.

Keep in mind that this is the year of the tax return that you want to pay. So check this against the balances you saw in your account details for each year that you owe. Select the oldest year to pay off, since the IRS wants to apply payments to those years before the most recent.

Select Continue, then confirm your selections and continue again.

The next page is the Verify Identity page. You’ll need to select the tax year (select the most recent for your address verification), your filing status, name, social security number, and address.

Select Continue to move on in the process. Finally, you’ll need to enter your direct deposit information.

First enter the amount you want to pay, then the routing number and account number of your bank account.

Select Continue again. The next few screens will just require you to confirm the payment amount and bank details. Then you’ll need to type your name to “electronically sign” for the payment.

Now that you’ve made a payment via the IRS Direct Pay system, the IRS has your direct deposit information for future reference.

Making Direct Payments to the IRS

Just remember to always select the Payment year as the same as the year from your account dashboard where you owe a balance to the IRS. Always select the Verification year as the latest year you filed taxes, and use your latest address so the IRS can confirm your identity for payment.

Unfortunately, the process of providing your direct deposit information to the IRS isn’t as straightforward as it could be. It’s not intuitive that to receive payments from the IRS that you would have had to have made a payment already. Thankfully, if you’ve never made any payment (only received refunds), the IRS does have the direct deposit information from your Tax Return that it used to give you that refund.

And if you don’t have anything on record either way with the IRS but you’re owed a stimulus payment, at least you now have the IRS Get My Payment page to provide your direct deposit details.